Amazon flex address for taxes.

En este video podrás ver cuáles son los recibos que debes guardar para llenar los taxes. Cualquier duda, deja tu mensaje y con mucho gusto te contestaré

But I also just did my taxes, and for whatever it's worth my Flex income info for 2019 came on a "1099-MISC" form, with Amazon's address listed as PO Box 80683 Seattle WA 98108. But as I said above, this is NOT needed to apply as a gig worker.There are three vehicle types that can be used to deliver packages for Amazon Flex in Australia: Sedans, Large Passenger Vehicles and Cargo Vans. Delivery block lengths vary by delivery vehicle type, so before you sign-up to start delivering packages, we recommend using our Large Vehicle Eligibility Calculator to confirm which delivery block opportunities …Amazon Flex offers delivery drivers the freedom and flexibility to be their own boss. The average delivery driver can earn from $114* for a 4 hour delivery block. With the Amazon Flex app, you’ll be able to see how much you’ll earn for each delivery block - all before your delivery block begins. Once you’ve completed a delivery, track ...Indiana's capital is famous for its speedway, where since 1911 the best racing drivers in the world have fought to win the Indy 500. Yet just a few miles away, white-tailed deer and red foxes run wild in the Great Lakes ecosystem, and migrating birds wheel overhead along the Mississippi Flyway. Downtown has a wealth of neoclassical buildings and is one of the …

Amazon Flex offers delivery drivers the freedom and flexibility to be their own boss. The average delivery driver can earn from $114* for a 4 hour delivery block. With the Amazon Flex app, you’ll be able to see how much you’ll earn for each delivery block - all before your delivery block begins. Once you’ve completed a delivery, track ...

Here is a comparison of Easy Ship and FBA Fees for a feature phone (non-Android mobile Phone) Product Info: Nokia 105 (2019) Product size category: Small. Unit weight: 300 gms. Shipping distance: National. Storage fees/unit: ₹ 3 (we charge ₹ 33/cubic foot/ month) Listing price on Amazon.in: ₹ 1000.

With Amazon Flex, you can earn on your terms with offer types that fit your life and goals. Most drivers earn $18-$25 an hour, and there are two main ways to earn with Amazon Flex: “blocks” that you can schedule in advance, and “instant offers,” which are deliveries that start right away. How do I file taxes for Amazon Flex? Filing taxes for Amazon Flex is easy. You will need to report your earnings on your tax return and make sure to deduct any …Amazon.in: Buy Bigflex Prime Whey Protein, 1Kg [ Coffee ] | 24G Protein | 4.25G BCAA ... Save 10% when you receive 3 or more products in one month to one address with Subscribe & Save. Currently, you'll save 5% on your Oct 20 delivery. Choose how often it's delivered ... Big Flex has contributed significantly to India’s health and fitness journey. …In todays video, I wanted to share with you guys how to file a tax return if you are self-employed. As an Amazon Flex, DoorDash, Uber Eats, Grubhub or any other …Yes. You fucked up. You only need to claim flex on your taxes as income if you made over $600 for self employment.. if you made less it doesn't have to be reported. But if you made more than that then you probably need to file an amendment so that you don't get in trouble.

When using Amazon Flex earnings as employment verification, it is important to keep in mind that: Your earnings statement will show only your earnings from Amazon Flex and does not include any other sources of income. Your earnings statement does not provide information about taxes or other deductions that may have been taken out of your earnings.

EIN. 911646860. An Employer Identification Number (EIN) is also known as a Federal Tax Identification Number, and is used to identify a business entity. Generally, businesses need an EIN. Business Name. AMAZON COM INC. Conformed submission company name, business name, organization name, etc. CIK. 0001018724.

A little tax insight for those who aren’t aware. Current mileage rate sponsored by our friends in the government or current deductible amount per mile driven for flex = $0.585/mi. 48,0000miles x 0.585/mi = $28,000 YOU DO NOT OWE TO THE GOVERNMENT IN TAXES. $40,000 (totals flex income) - $28,000 in deductible income = $12,000 is the actual ...Jun 10, 2021 · July 26, 2021. Amazon flex most of the time doesn’t pay enough to cover the IRS deduction per mile. Example today I picked at a Amazon distribution center 3.5 hour route paid 18 per hour. Total miles from pickup to last delivery 138 miles. IRS deduct per mile is 0.56 cents per mile equals $ 77.28. Amazon flex is a courier service from Amazon Incorporations that enables private individuals to use their vehicles to deliver packages for Amazon as a way of earning extra money. An Amazon flex driver, therefore, can be described as one who is saddled with the responsibility of transporting and/or moving various items from Amazon production …Oct 3, 2023 · For example, Amazon Flex drivers can text customers right from their phone — something support cannot do. On most delivery labels, the customer’s phone number is below the first barcode and above the QR codes. Calling Direct. There are two Amazon Flex support phone numbers: (877) 212-6150 and (888) 281-6901. Full list of the 7 Amazon Flex Warehouses & Delivery Locations near Houston, TX RTX3 - Houston 998 Bagby St, Houston, TX 77002 Location is approximate ...We would like to show you a description here but the site won’t allow us.WoW Party Studio Flex Personalized Frozen Elsa Theme Birthday Party Background Banner with Birthday Boy/Girl Name (Multicolour, 4ft Height x 5ft Width) 17. Great Indian Festival. ₹504. M.R.P: ₹760. (34% off) Get it by Sunday, 15 October. Ages: 6 months and up.

Amazon Flex offers delivery drivers the freedom and flexibility to be their own boss. The average delivery driver can earn from $114* for a 4 hour delivery block. With the Amazon Flex app, you’ll be able to see how much you’ll earn for each delivery block - all before your delivery block begins. Once you’ve completed a delivery, track ... Amazon Air, a cargo airline for bulk transport, with last-mile delivery handled either by Amazon Flex, Amazon Logistics, or the US Postal Service. Amazon Flex , a smartphone app that enables individuals to act as independent contractors, delivering packages to customers from personal vehicles without uniforms. How to start your free return: 1: Go to your Amazon account to start return (s). 2: Choose your preferred store as your drop-off location. 3: Bring the item (s) to the Customer Service desk or Amazon Counter kiosk — no box or label needed. 4: Show the QR code from the app or your return request confirmation email to the team member.Mailing Address: Incorporation Details: The CIK for Amazon Com Inc is 1018724. Central Index Key (CIK) is used to identify corporations who have filed disclosures and other filings with the SEC. The Employer Identification Number (EIN) for Amazon Com Inc is 91-1646860. EIN numbers are also referred to as FEIN or FTIN.EIN. 911646860. An Employer Identification Number (EIN) is also known as a Federal Tax Identification Number, and is used to identify a business entity. Generally, businesses need an EIN. Business Name. AMAZON COM INC. Conformed submission company name, business name, organization name, etc. CIK. 0001018724.We may ask for your tax Identification number (SSN, EIN), legal name, physical address, and date of birth. We will use this information to identify you and to comply with tax reporting obligations applicable U.S. taxpayers. If you have more than one account with Amazon, you must complete the information for all of your accounts.

Reddit - Dive into anything

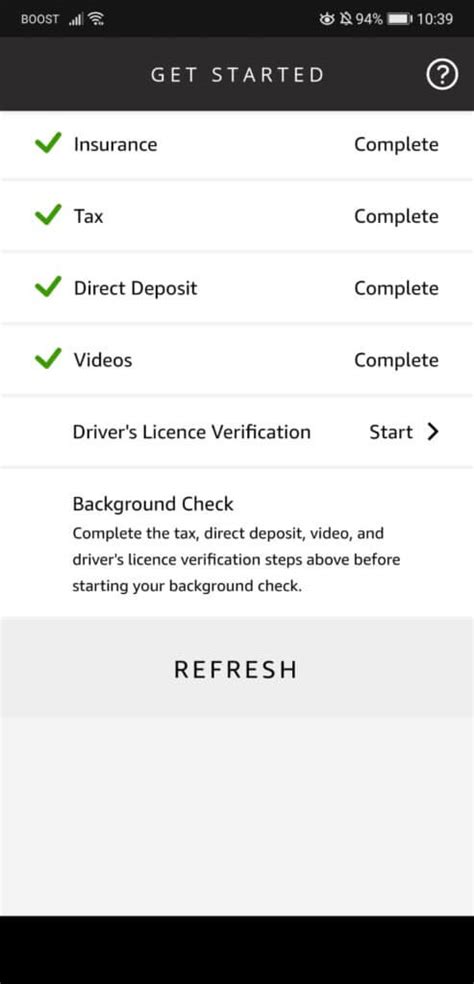

Before you sign up to deliver with Amazon Flex, you will need to first check that you meet our requirements before you can choose your own hours and start earning extra money. These requirements include: 1. Living in an area where Amazon Flex operates (check our Locations page). 2. Being 20 years old or older. 3. Having a qualifying vehicle. 4. 18 de set. de 2023 ... ... address any concerns with Amazon Flex support if needed. ... In addition to federal taxes, you may also have state taxes withheld from your Amazon ...Getting Started. The interview is designed to obtain the information required to complete an IRS W-9, W-8 to determine if your payments are subject to IRS Form 1099-MISC or 1042-S reporting. In order to fulfill the IRS requirements as efficiently as possible, answer all questions and enter all information requested during the interview. Apr 25, 2022 · According to Amazon, flex drivers earn $18-$25/hour. And the average Amazon Flex pay is $21.36/hour, as per Indeed. However, your actual Amazon Flex salary will depend on several factors, such as: Your location. The amount of time you take to complete deliveries. Getting Started. The interview is designed to obtain the information required to complete an IRS W-9, W-8 or 8233 form to determine if your payments are subject to IRS Form 1099-MISC or 1042-S reporting. In order to fulfill the IRS requirements as efficiently as possible, answer all questions and enter all information requested during the ...Amazon.in: Buy Bigflex Prime Whey Protein, 1Kg [ Coffee ] | 24G Protein | 4.25G BCAA ... Save 10% when you receive 3 or more products in one month to one address with Subscribe & Save. Currently, you'll save 5% on your Oct 20 delivery. Choose how often it's delivered ... Big Flex has contributed significantly to India’s health and fitness journey. …15 de mar. de 2018 ... The IRS may address that issue at a later date, and if so, it could reduce the amount of income that would qualify for the 20% reduction ...Amazon Payments will mail a copy of your form to the address which you provided when you gave us your Tax ID Number (EIN or Social Security Number). If you have agreed to receive your form electronically, you may access your form by logging in to your Seller Central Account through https://sellercentral.amazon.com , clicking Reports , and then ... 3. Next to Password, click or tap Edit. 4. Enter your current password and new password, and click or tap Save Changes. How do I update the email address on my account? You can update your ...

Job Overview. You’ll be part of the Amazon warehouse team that gets orders ready for customers relying on Amazon’s services. Our fast-paced, active roles take place in various areas, including merchandise, make-on-demand, customer returns, and general fulfillment — in some cases for our super-fast (2-hour or less) delivery service.

Amazon Payments will mail a copy of your form to the address which you provided when you gave us your Tax ID Number (EIN or Social Security Number). If you have agreed to receive your form electronically, you may access your form by logging in to your Seller Central Account through https://sellercentral.amazon.com , clicking Reports , and then ...

Amazon Flex misclassified a driver as an independent contractor and is now required to pay unemployment insurance taxes for all similarly classified Flex ...Amazon Flex will not withhold income tax or file my taxes for me. As a self-employed independent contractor you will have to pay taxes and self-employment tax on your business income. You will need to report your business income to the IRS and pay any amount that is due. You will also have to pay unemployment tax on any income you …How to set your tax classification with Uber. In the Uber Driver app, tap Menu > Account > Tax Info > Tax Settings. On the tax settings screen, you can select your federal tax classification, and enter your company legal name, DBA, and EIN. Change your tax settings in the Uber Driver app. Options on the Uber Tax settings page.Amazon promotes Flex as a way for people to earn extra money on top of their ordinary jobs, using their own cars to deliver packages to customers' homes in 4-hour shifts known as "blocks".How to set your tax classification with Uber. In the Uber Driver app, tap Menu > Account > Tax Info > Tax Settings. On the tax settings screen, you can select your federal tax classification, and enter your company legal name, DBA, and EIN. Change your tax settings in the Uber Driver app. Options on the Uber Tax settings page.As Amazon makes one-day shipping the norm for its 100 million Prime members, Flex drivers help get those packages the last mile to each address. CNBC spoke to these on-demand contract workers all ...Amazon Flex offers delivery drivers the freedom and flexibility to be their own boss. The average delivery driver can earn from $114* for a 4 hour delivery block. With the Amazon Flex app, you’ll be able to see how much you’ll earn for each delivery block - all before your delivery block begins. Once you’ve completed a delivery, track ...Amazon Flex Australia Requirements. To become a delivery driver for Amazon Flex Australia, you must live in a region Amazon Flex operates in, have an eligible delivery vehicle, a valid driver's licence for your vehicle, car insurance, and an iPhone or Android smartphone. The Amazon Flex app is where you will complete your registration, schedule ...Here is a comparison of Easy Ship and FBA Fees for a feature phone (non-Android mobile Phone) Product Info: Nokia 105 (2019) Product size category: Small. Unit weight: 300 gms. Shipping distance: National. Storage fees/unit: ₹ 3 (we charge ₹ 33/cubic foot/ month) Listing price on Amazon.in: ₹ 1000.

U.S. law requires Amazon.com to collect tax information from Associates who are U.S. citizens, U.S. residents, or U.S. corporations and certain non-U.S. individuals or entities that have taxable income in the U.S. We're obligated to have this information on file in order to make payments.Download the Amazon Flex app. Download the Amazon Flex app. Download the Amazon Flex app. Why Flex Let's Drive Safety Rewards FAQ Blog. Download the Amazon Flex app to sign up. How do I sign up for Amazon Flex? Becoming an Amazon Flex delivery driver is easy. Simply scan the QR code on the right using your iPhone or Android camera, and …what you need? We're here to help. Frequently asked questions about Amazon Flex Getting Started What is required to deliver with Amazon Flex? To sign up with Amazon Flex in the UK, you will need an iPhone or Android smartphone (and you must be 18 years or older.Instagram:https://instagram. publix super market at promenade at pleasant hillcartman girlfriend heidi episodefatal accident on i 40 west of albuquerque todayunemployment calculator kentucky Make quicker progress toward your goals by driving and earning with Amazon Flex.Full list of the 35 Amazon Flex Warehouses & Delivery Locations near Seattle, WA RWA4 - Seattle 909 5th Ave, Seattle, WA 98164 Location is approximate Show on Map UWA3 - Seattle 2121 8th Ave., Seattle, WA 98121 Show on Map UWA4 - Seattle 76 ... texas roadhouse menu with calorieshouses for sale in lasalle county il Maximize your earnings with Amazon Flex Rewards. With Amazon Flex Rewards, you earn points by making deliveries. As you earn more points, you’ll level-up and gain access to new rewards. You’ll have access to exclusive discounts on a wide range of categories like gas, roadside assistance, and car maintenance, in addition to cash back on ... mickey mouse clubhouse hot dog lyrics Hover over your email address displayed in the top right corner, and select Account Settings. Scroll down to Payment and Tax Information. Click on Find Forms, at the bottom of the pageLogin or register as a seller on Amazon.in and manage sales, inventory and your business operations on the Seller Central dashboard. Log in. Start selling. ... By submitting feedback, you acknowledge that no personal or sensitive data is included with your response (e.g., names, addresses, telephone numbers or email addresses). Submit. Thanks for the …